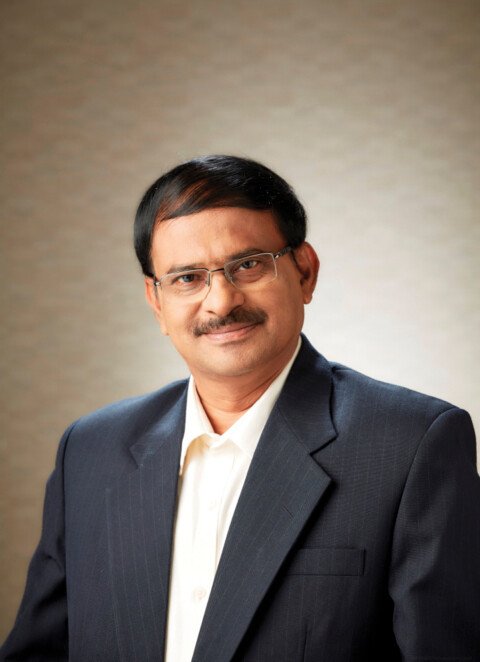

Starting from collection to delivery/distribution of pharma products, logistics service providers need to arrange for maximum safety of the consignment. Since pharma logistics constitute important stages of the storage and distribution operations for any pharmaceutical business, pharma companies are ready to spend to improve efficiency, and therefore logistics providers have a great opportunity to cater here. Srinivasulu Reddy Venati, Vice President- Demand Planning & Logistics at Glenmark Pharmaceuticals (India), in a conversation with Upamanyu Borah, explains about logistics and SCM that need to continue to coordinate actions to address the ongoing challenges of cold chain logistics and contribute towards the enhancement of productivity and growth of the pharmaceutical industry.

2020 has been a challenging year for everyone. How do you think the COVID-19 pandemic has changed the industry?

I have been in the industry since the last 36 years, ‘never seen anything like it’. Since the last seven months, we have been working from home and this has become inevitable. In pharmaceuticals and other manufacturing industries, work from home is not possible given the nature of operations. Initially, towards the end of March while we were closing our annual sales, it was the COVID-19 outbreak that hit us hard. During April, although there were issues with continuing operations, but from the sales volume point of view, the impact was quite lesser than the previous month.

Disruption of logistics and scarcity of workers were the major challenges being faced by the pharmaceutical industry in the wake of the pandemic. Unavailability of vessels, closure of ports and Customs offices and then the restrictions on local transport movement posed hitherto unknown challenges for both inbound and outbound movement. As air express cargo continued to function, it was being deployed for movement of essentials and medical supplies as well as non-essential commodities wherever regulatory authorised. The most important test for the industry was to get the entire logistics operation acclimated to the new normal of operating, including contactless delivery. For instance, the collaborative efforts for consolidation of goods amongst super distributors and carrying and forward agents (C&FAs) helped them to adapt their distribution networks accordingly and deliver to the stockists.

A remarkable change was, earlier we used to collect physical cheques issued with orders, and now cash transactions have drastically reduced. The coronavirus impact did offer a glimpse of what an unexpected, macro-economic event can do to people’s payment behaviour.

You first took on the role of Vice President – Demand Planning & Logistics for Glenmark India in 2005. What have you witnessed as the most impactful trends that the Indian pharma supply chain has undergone during this period?

Back then, the issue was extended time taken to get the stocks to the trade, or from the plants to the central warehouse. In the last few years, India’s road infrastructure has seen consistent improvement. Connectivity has improved and road transportation has become a focus of rapid development. Roads are providing better access to services and ease of transportation. Because of the market development status, and future truck-as-a-service market trend, we are able to push more stock utilising bigger or multi-axle trucks.

Business communication apps and online chat platforms are all in one service that helps companies better their workflow. Instead of allowing everything on mail, these platforms have allow companies to create groups and communicate in real-time, while also sharing files and messages over the service. In some cases, these also work as collaboration tools to help employees expedite work flow.

Today, with the increased support from banks, funds are available to the trade. It has increased access to credit for small firms and stockists, with lower interest rates, improving borrower discipline and supporting bank supervision and credit risk monitoring.

Could you elaborate on how Glenmark underscores the leadership position in disease prevention and disease-modulation by means of innovative and ever-transforming pharma value chain engineering?

Over the years, Glenmark’s success has depended on strong leadership and market innovation focussed on tackling some of the toughest health challenges.

The company has been hiring people from different sectors of operations to bring in a cross-functional performance system and employee professional support through social cohesion and capability development. Glenmark’s supply-chain function’s organisational design interacts with its assets, technology, processes, and people to make strategy happen. The company HR teams have been encouraging and sponsoring its people to knowledge‐sharing platforms that enhances team learning, gives us opportunities to problem solve with others around the world as well as provide expertise.

Alongside people innovation, Glenmark has leveraged digital innovation, in close coordination with consulting firms for digital strategy, to make products and services more personalised, end-to-end digitalisation to integrate supply chain workflows to drive efficiencies, decisions and product evidence more data driven, and business processes more immediate.

India is one of the main players in finished formulations in the short-term and many pharma companies are focussing on the Indian market and establishing connections with local companies. What you believe could be the key success ingredients?

Government support is the most required, especially to ring in regulatory changes to give more tax and other incentives to pharmaceutical companies that want to set up research and development (R&D) base in India.

In general, for any company that wants to establish itself in the business, it would require 3-5 years and large amount of investments overtime. Government should arrange funding options and financial incentives for pharmaceutical firms in India to grow and scale up domestic production. It has been felt that domestic production of APIs and medical devices have to be ramped up in order to eliminate any risk to India’s health security.

Looking more specifically at the current bottlenecks impacting the country’s overall logistics infrastructure, what would you underscore as the first priorities that stakeholders should focus on?

First and foremost, transporters and logistics service providers should focus on establishing infrastructure stability. The expectations are for cold chain logistics players to have the same commitment to speed and quality as companies researching and developing highly specialised pharma. Poor infrastructure and transport facility is a big obstacle for cold chain supply. The problem becomes even more severe when temperature-sensitive drugs are required to be transported to remote areas and where there is lack of storage and cold chain facilities.

The need for proper logistics management, which includes temperature-controlled vehicles and warehouses, has become important for the pharma industry of India. In-house training on to product handling and training centres need to be set up to educate the front level people who handle these sensitive products. Overall, government support in the form of investments and regulatory interventions is integral to initiate growth of the industry, improve the quality and streamline operations in pharma.

The Indian market is well-known as one of the most innovative markets globally but on the other hand, access and affordability have been enduring issues as a result of many factors. What kind of positive change do you hope to see in the Indian market?

A lot of change is coming. Looking at the trade front, pharma companies today seek assistance of online retailers to market their products. Now, this will bring down the number of stockists. Once government notifies the final e-pharmacy rules and formal recognition and regulation of online pharmacies, the scenario is set to change drastically. These firms will set up their own hubs and will tie up with manufacturers for big volume orders. E-pharma has always been a lucrative segment for investors in terms of its strong value proposition and long-term gains. It offers competitive pricing, access to quality products, high discounts, complete information regarding the ingredients and sources of medicines and other details about usage. That being said, e-retail companies do have the advantage of a huge online transacting consumer base and a ready delivery system.

How do you plan to remain agile in potentially much-changed healthcare value chain landscape?

The implementation of GST has been a positive step for the pharma industry. The subsuming of sales tax as well as inter-state taxes within GST helped us to consolidate and operate from a few centralised warehouses to distribute goods to the rest of the country. In some states, we have 2-3 super distributors and we are further looking to consolidate to limit their number. Besides, we are also considering consolidation of manufacturing units, which will allow consolidation of functions such as order management, purchasing and inventory, leading to greater operational efficiencies. Specifically, the supply chain benefits from this type of consolidation are achieved through costs savings derived from increased volumes.